Electronic health record (EHR) vendors are increasingly cannibalizing clinical departmental IT administration, such as radiology information systems and cardiology information systems. Best-of-breed laboratory information systems (BoB-LIS) are often viewed as the next departmental IT lamb headed for slaughter at the altar of the EHR.

Is EHR-based LIS therefore a foregone conclusion? Or is there a place still for dedicated BoB-LIS? Based on our latest research assessing the global LIS market, the evidence points to a surprisingly bright future for BoB-LIS.

The COVID dividend

Unlike some segments of healthcare IT, the LIS market has had a very positive two years. COVID-19 testing directly resulted in a spike in requests for laboratory services and pushed providers to purchase higher volumes of equipment to conduct testing.

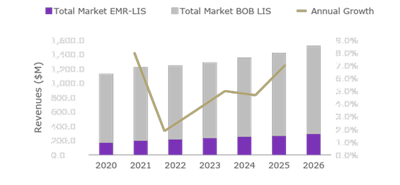

For LIS vendors, this resulted first in increased demand for integration, while also benefiting vendors that had structured their pricing around annual testing volumes. This demand continued into 2021, with the worldwide market reporting 8% year-over-year growth, as seen in Figure 1.

Despite some challenges to come near-term, the overall outlook for the market across Signify Research's forecast remains positive. The requirement for well-equipped labs and greater accessibility and interoperability of data has intensified over the last two years, driving accelerated investment in most regions midterm.

Figure 1: World Market for LIS Systems

Figure 1: World Market for LIS Systems

Challenges still to overcome

Despite this positive global outlook, the market outlook in the U.S. is less positive. In the U.S., bifurcation between EHR-LIS and BoB-LIS, described in Table 1, is most apparent.

| Table 1: Report Definitions | ||

| Type | Definition | Example Vendor |

| BoB-LIS | LIS that is implemented standalone in a project separate from EHR deployments (excludes integration into third-party systems) | Sunquest Information Systems |

| EHR-LIS | LIS software implemented as part of a monolithic EHR rollout | Epic Beaker |

The advantages of EHR-LIS adoption are clear to providers. EHR vendors offer a comparatively lower price point when combining LIS software with EHR implementations; this comes with the added advantage of simplifying the hospital IT supply chain. Consequently, EHR-LIS has cannibalized segments of the U.S. market from BoB-LIS in recent years, resulting in an overall market revenue retraction over the forecast period.

This trend has mostly been limited to the U.S., where the dominating influence of a few EHR vendors has been most evident. EHR-LIS implementations do, however, come with some trade-offs for lower pricing and consolidation, such as a loss in specialization for workflows and lab types. Therefore, in some markets outside of the U.S., providers have retained a preference for BoB-LIS and are predicted to continue to do so over the forecast. Examples include more mature markets like the UK, the Netherlands, and Nordic countries, but also emerging regions such as Latin America.

Other factors have also slowed EHR-LIS penetration in some markets. These comparatively "safe" markets are either increasingly saturated with low-cost domestic competitors or are about to reach maturation with a rapidly consolidating customer base. Western Europe is a prime example of the latter, while markets such as Brazil often start at price points sitting at ~25% of their Western European counterparts.

Facing maturation inertia in some markets, low-cost domestic competition in others, and the increasing presence of EHR-LIS driven by C-Suite decision-makers, how do LIS vendors continue to achieve growth and prevent customer attrition?

Option 1: Acquire the competition

One method of growth that has benefited market leaders in terms of both revenue and customer shares has been acquiring smaller businesses. Dedalus is the prime example of this, having most recently acquired a Germany company (OSM) to solidify its position in the German-speaking region of Europe.

Figure 2: Worldwide LIS revenue market share

Figure 2: Worldwide LIS revenue market share

This strategy allows vendors to achieve short-term growth in both revenues and customer bases, as well as sidestepping issues such as customer loyalty and learning unique market characteristics upfront.

However, it is also not without its challenges. When handled incorrectly, acquisitions can lead to difficulty in retaining incumbent workforces, and challenges in assimilation and integration can leave customers dissatisfied and ready to leave established vendors. The more companies that are acquired over a shorter period, the harder these transitions are to manage.

Option 2: Focus on growing laboratory segments

The second option for vendors to pursue growth is to diversify portfolios into wider lab software. There are many different opportunities here, with the most common being genetics-based LIS software or "patient engagement" add-ons. Both these segments within lab services are growing quickly, and therefore present an opportunity for labs to retain the specialization they are renowned for, whilst also expanding and improving offered services.

While there is a large range of possible lab subsegments that are attractive for vendors to pursue, there is some risk. For example, within genetics there is the ever-present threat that existing companies such as Illumina, which dominates its own market, might choose to expand and offer a genetics-specific LIS. If current LIS vendors choose to develop in-house solutions, the time taken for development may already see the market saturated before entry if major genomics players gain first-mover advantage.

Option 3: Ally with another product sector

The next (and currently least common) method for growth focuses on the growing presence of EHR-LIS deployments. Although these are predicted to grow in number over the forecast, there are opportunities BoB-LIS vendors may choose to capitalize on. There are three prominent examples worth considering:

- EHR/HIS partnership: A&T Corporation in Japan had previously partnered with major hospital information system (HIS) vendors in the region to sell BoB-LIS into hospitals -- an action that has effectively prevented EHR encroachment and allowed the vendor to retain its high market share.

- Leverage other clinical IT portfolio assets: Citadel Health's entry into the U.K. market via the acquisition of domestic RIS vendor Wellbeing Software. This provided an "in" with existing U.K. hospitals and has allowed the company to win several new contracts recently.

- Leverage wider lab portfolio: Larger reagent and lab equipment providers like Sysmex or Werfen provide LIS bundled with other lab equipment. These vendors are less concerned with the growth of the LIS segments, often offering LIS at comparatively lower price points (like EHR) to secure larger deals, which can act to inhibit growth in markets.

The above examples have worked remarkably well in practice, allowing vendors to capitalize on the trend toward supply chain simplification evident in most healthcare markets. Although it does rely somewhat on cooperation and cohesion in sales strategies, this approach has the most promise.

However, we would caution against the practice of discounting software too much within bundled deals, as history shows that often this can lead to poor product development in later years, mitigating the overall value of the product significantly.

Option 4: Diversify out of healthcare

The last option open to LIS vendors involves moving out of healthcare into traditional LIMS environments. CliniSys has recently opted to traverse this route with the acquisition of both Horizon Lab Systems and Common Cents Systems.

This again involves vendors entering an already mature market, and thus entails significant risk. It also does not address EHR encroachment directly and could result in a loss of hospital IT specialization, as LIMS and LIS often involve separate workflows.

Although this may prove beneficial when targeting the private sector, which often has labs involved in several different lab services, it can be argued that this strategy offers no advantages for the hospital segment's market or providers.

But will the lambs fall silent?

There clearly remain many options for BoB vendors operating within the laboratory industry, with each strategy holding its own risks and merits. It's not all doom and gloom, however, as while cost-conscious decision making may have driven cannibalization in some markets, a final dividend remains from COVID.

The pandemic underscored the requirement for top-tier workflows to remain within the healthcare lab, a fact certain to be front and center in decisionmakers' minds for at least the next few years. This may be the lifeline and growth thrust that allows BoB-LIS vendors to establish a stronger foothold and repel EHR-LIS for the long-term outlook.

About the report:

This research relates to Signify's study "Laboratory Information Systems -- World - 2022," which provides a data-centric and global outlook on the current and projected market for laboratory information systems in clinical settings. To find out more, please email the report author Imogen Fitt at [email protected].

The comments and observations expressed are those of the author and do not necessarily reflect the opinions of LabPulse.com.