Early in 2020, global digital pathology markets experienced slowing demand due to reduced orders and budget freezes as the COVID-19 pandemic surged, but the market slowly recovered and picked up in the second half of 2020. In 2021, the digital pathology market was valued at $866 million, and future opportunities of digital pathology coupled with emerging companion diagnostics abound, Bruce Carlson of Kalorama Information writes.

The digital pathology market, which consists of hardware, software, and related services for clinical applications, has largely benefitted from the COVID-19 pandemic, allowing pathologist to read, evaluate, and collaborate remotely, improving efficiency and productivity.

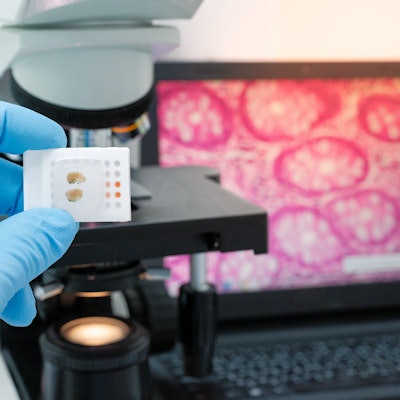

In addition to digital microscopy, the use of high-throughput, automated digital pathology scanners allows laboratories to capture an entire glass slide (whole slide imaging, WSI) under bright field or fluorescent conditions at a magnification comparable to a microscope. The slides are scanned at high resolution to create an analog image and then digitized using a computer. The device identifies certain focal points in the tissue and scans them frame-by-frame. Digital data storage allows access to all desired scans or patient reports. A comparison of scans with archive images is possible at any time, but these images require very large storage capacity.

Digital slides can be shared over networks using specialized digital pathology software applications. Automated image analysis tools can also be applied to assist in the interpretation and quantification of biomarker expression within tissue sections.

The rapid progress of WSI technology, along with advances in software applications, laboratory information system (LIS)/(LIMS) interfacing, and high-speed networking, have made it possible to fully integrate digital pathology into the pathology workflow. In short, WSI can and is revolutionizing tissue.

Opportunity exists for the potential future use of digital pathology for quantitative analysis of emerging companion diagnostics. This opportunity may become especially relevant with the advent of assays that are difficult to discern with the human eye, such as multiplex, or markers that exhibit diffuse staining characteristics across multiple cellular compartments of which, for example, only one may be clinically relevant. The increasing complexity of such assays is driving the development of digital pathology solutions with advanced high-throughput image capture coupled with pattern recognition to morphologically identify relevant tissue types and individual cellular compartments followed by the ability to quantify (IHC) intensity of staining.

Drivers and limiters to the digital pathology market

There are a number of drivers and limiters that influence the digital pathology market. Each of these continue to impact the market either positively or negatively.

Drivers

The most import drivers affecting the digital pathology market include:

- Affordable scanners

- Increased demand

- Rising disease prevalence along with an aging population

- Improved laboratory workflow, customization, and productivity

- Telepathology implementation

- Continued automation of the lab and digitalization of healthcare

- Regulatory changes that benefit digital pathology.

Limiters

- Cost of implementing digital pathology solutions and ROI

- Technological infrastructure to support digital pathology

- Lack of skilled personnel

- Lack of physician education and desire to change

- Slow regulatory process

- Fragmented digitalization in clinical and lab sector

Many of these drivers and limiters have been present for many years, but the pandemic helped to address some of these and there is renewed momentum to advance the market further. We have already seen many new entrants into the digital pathology software market and improving models to meet the needs. Radiology information technology is influencing digital pathology growth due to the increasing inclusion of pathology in enterprise imaging deals.