As a crucial part of life science workflows, polymerase chain reaction (PCR) is a major market sector of the laboratory tools industry. The total market for PCR products, excluding IVD applications, is estimated to top $5 billion next year with a compound annual growth rate of over 5% between 2021 and 2026, according to market research firm Strategic Directions International (SDi), part of Science and Medicine Group, and a sister brand to LabPulse.

The market estimate includes initial instrument purchases as well as aftermarket sales, such as components and consumables.

PCR encompasses a number of techniques which can be categorized as traditional PCR, real-time PCR, and digital PCR (dPCR). A key feature of the market is that consumables account for 70% of demand, making it highly profitable as it can guarantee a regular revenue stream. Consumables examples include clean-up kits and master mixes.

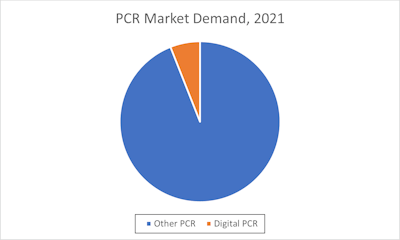

dPCR is the fastest growing PCR technology, evidenced by the recent entry into the market of quantitative PCR (qPCR) vendors such as Roche and Qiagen. Other PCR market participants selling dPCR instruments include Bio-Rad Laboratories, Fluidigm, and Thermo Fisher Scientific.

Among its advantages, dPCR does not require a standard curve for absolute quantification of target DNA molecules, it has more precision and accuracy in the presence of inhibitors, and it provides accurate quantification when the amplification efficiency is low. Some of the most common applications of dPCR are rare mutation detection, copy number variation analysis, and microbial pathogen detection.

The adoption of dPCR has grown quickly, with over 40% of the 248 scientists surveyed for the SDi report stating that they use it in their labs. The first dPCR system, the BioMark System, was launched in 2006 by Fluidigm, becoming the company’s flagship product. The market notably expanded in 2011 when QuantaLife was acquired by Bio-Rad Laboratories and Bio-Rad introduced QuantaLife’s Droplet Digital dPCR technology. As an established qPCR company and broad-based life science tool vendor with over $1 billion dollars in sales, Bio-Rad introduced its dPCR technology to its customer base and broadened the application base.